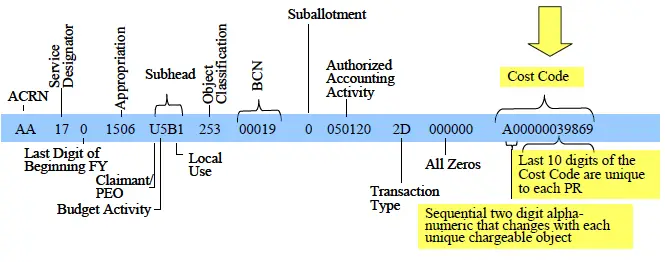

A Line of Accounting (LOA) is the funding associated with a federal organization’s budget. By understanding the elements that comprise an LOA, you can determine the Service designator, fiscal year, appropriation, subhead, object class, plant UIC, sub-allotment, authorized accounting activity, transaction type, and Work Breakdown Statement (WBS) element/cost element.

Definition: A Line of Accounting (LOA) is used to identify the funding source associated with an organization’s budget to ensure accurate accounting transactions.

Line of Accounting (LOA) Methods

Each of the various federal agencies has a different method for cost accounting. A typical string of accounting data found on a requirements document is 30 to 40 characters in length. Each of these characters is broken out differently in accordance with the accounting practices of the providing agency. However, the first 9 digits are the same for all agencies. The Appropriations Code is tied to the Appropriation Categories

Guide: LOA Formats by Service Agency and LOA Data Elements For Customer Identification Codes (CICS)

Line of Accounting (LOA) Service Designator Code

- Air Force – 57

- Army – 21

- Navy – 17

- DoD – 97

Example Fund Site Breakdown

See Fund Site Breakdown for another example

Example: 5713010 111 4720 119992 020100 00000 000000 503000 F03000

- Department: 57

- Fiscal Year: 1

- Appropriation Symbol: 3010

- Fund Code:11

- Fiscal Year: 1

- Operating Agency Code: 47

- Allotment Serial Number: 20

- Budget Program (First 2 digits of BPAC): 11

- Project Number (3rd thru 6th digit of BPAC): 9992

- Material Program Code: 020100

- Element of Expense/Investment code (EEIC): 000000

- Program Element (PE): 000000

- Accounting and Disbursing Station Number (ADSN): 503000

- DoD Activity Address Directory Code (DoDAAC): F03000

Standard Line of Accounting (LOA)

The DoD transitioned to the Standard LOA on April 1, 2022, Fund Codes are no longer being used except by services that require them. At this time, only the Air Force requires Fund Codes. Therefore, each Agency must now research and determine the availability period for all appropriations.

AcqLinks and References:

- Financial Management Compendium

- Lines of Accounting (LOA) Formats by Service Agency and LOA Data Elements For Customer Identification Codes (CICS)

- DoD Standard Line of Accounting Class Memo – 2012

- Website: 31 U.S.C. 1301 – Application

- Website: DoD Comptroller: DoD 7000.14R – (Most Updated Versions)

Updated: 2/15/2024

Rank: G1.3